From EVs and batteries to autonomous vehicles and urban transport, we cover what actually matters. Delivered to your inbox weekly.

In the last month, EV infrastructure stopped being a slow roll and turned into a global sprint.

India extended national EV subsidies through 2028.

China’s ultra-fast rollout is pushing toward 100,000 new chargers.

The UK and South Korea are upgrading home and public access.

And across Southeast Asia and the Middle East, local governments are skipping the “pilot” stage and moving straight to scale.

Charging is no longer just a support layer. It’s becoming the product — and a key part of how regions compete, attract investment, and shape mobility habits.

This week’s issue breaks it down:

Let’s dive in.

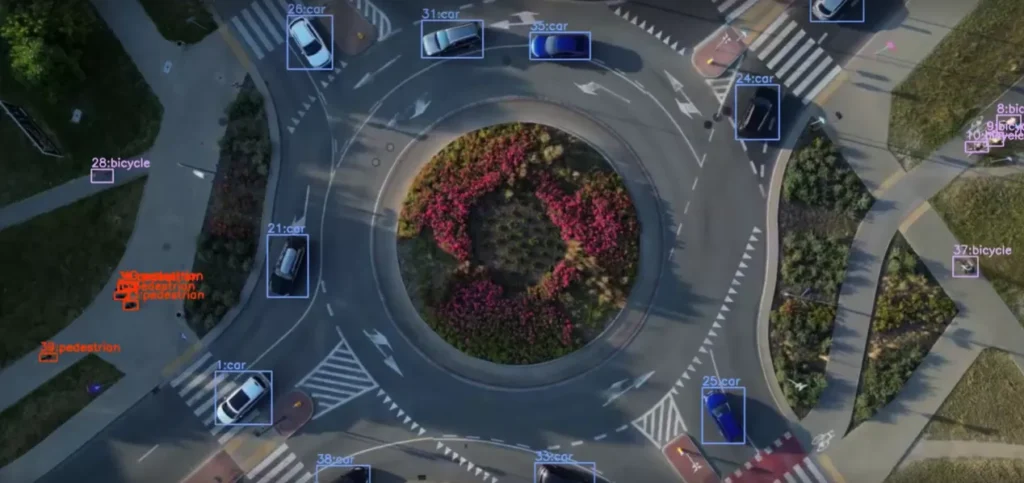

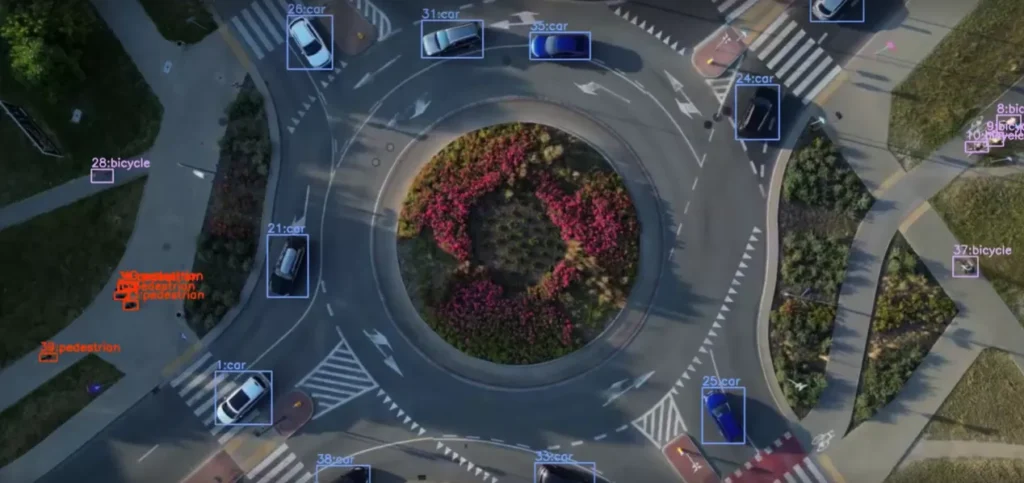

Autonomy is coming fast, but most of our infrastructure wasn’t built for it. That’s where Autolane steps in.

Founded in 2024 and based in the Bay Area, Autolane is building the universal infrastructure layer for autonomous ride-hailing and delivery. Their product, OpenCurb, turns high-traffic commercial parking lots into smart, AV-ready zones for seamless pickups and drop-offs.

🚗 Live pilots in Austin and San Francisco

🏙️ Designed for retailers, restaurants, and shopping centers — not city streets

📸 Uses vision-based sensors and ALPR tech to check in authorized vehicles automatically

For years, charging was treated like a side project.

Governments issued scattered subsidies. Automakers focused on range. And private operators raced to install stations, often in the wrong places, with no long-term plan for usage, maintenance, or grid integration.

Access was inconsistent and reliability was worse. All this resulted in a network that looked ambitious on paper, but failed to build confidence with actual drivers.

That’s changing fast. The last month made one thing clear:

Charging is no longer a check-the-box metric. It’s becoming policy, product, and competitive edge.

The focus here really stands out.

Countries are aligning infrastructure with behavior, geography, and actual vehicle mix.

The next wave of charging growth will be about quality of experience and who controls it. Here’s how we see it:

And what about the governments? They’ll be judged less by how much they fund and more by how clearly they design the rules of the ecosystem.

We have some catching up to do.

🌐 Honda’s Fastport eQuad Wins Red Dot: Best of the Best 2025

Honda’s all-electric Fastport eQuad, designed for last‑mile delivery, scored the prestigious Red Dot “Best of the Best” design award. (Honda News)

🇶🇦 Qatar Adds 300+ Fast EV Chargers

Qatar has installed over 300 new fast chargers capable of charging EVs to 80% in just 30 minutes, supporting its push for sustainable urban mobility. (Economic Times)

🇮🇳 India Extends PM E‑Drive EV Subsidy Scheme to 2028

India’s government extended the ₹10,900‑crore PM E‑Drive EV incentive program to March 2028—though two‑ and three‑wheeler subsidies will end earlier. (Times of India)

🇮🇳 Delhi, Maharashtra, Chandigarh Lead India’s EV Index

According to NITI Aayog’s new Electric Mobility Index, these three regions top EV adoption in India, with 29 states now implementing EV-friendly policies. (Economic Times)

🇿🇦 South Africa Looks to Norway for EV Lessons

Industry leaders in South Africa are drawing on Norway’s success in EV adoption to inform local policy and industrial strategy. (ESI-Africa)

🚍 India’s Tata Motors to Supply 100 EV Coaches to GEMS

Tata Motors signed an MoU to provide 100 electric intercity coaches to Green Energy Mobility Solutions (GEMS), supporting Tamil Nadu’s transition to clean mass transit. (Times of India)

🚚 GM Silverado EV Sets New Range Record

A production Silverado EV achieved a real-world range of 1,059.2 miles on a single charge, breaking the previous high of 749 miles set by Lucid. (Battery Tech Online)

For years, EV charging was framed as an infrastructure problem.

There were not enough plugs, they weren’t in the right places, and they weren’t reliable.

That’s still true in parts of the world, but in 2025, the story has shifted. Charging is becoming a lever for investment, influence, and industrial alignment.

Let’s unpack this stuff and break some myths.

🚫 Reality: Everyone’s building with a motive.

This month’s charging announcements are all about staking claims:

Behind every charging deployment is a deeper strategy: industrial policy, supply chain alignment, or geopolitical signaling.

🚫 Reality: Public–private lines are blurring.

In South Korea, government funding now requires “smart-managed” chargers, designed to balance grid loads and communicate with local utilities. The state is dictating how charging works, not just where it gets built.

In the UK, new funding targets drivers without off-street parkings and is paired with cross-pavement tech trials for direct-to-home charging. The market signal? Convenience matters more than charger count.

Meanwhile, Australia launched a national EV infrastructure mapping tool for private networks to plan better deployments.

🚫 Reality: The future is mixed and regional.

There won’t be one global model. There will be regional stacks, shaped by infrastructure ownership, vehicle mix, and policy maturity.

Want to know what a country values?

Watch how it funds, regulates, and builds EV charging.

Fast chargers on highways? That’s long-distance mobility.

Slow chargers at malls? That’s urban saturation.

Subsidies tied to local hardware? That’s industrial sovereignty.

Roland Berger’s latest EV Charging Index ranks 33 countries on infrastructure maturity, tech readiness, and user satisfaction, based on surveys with 12,000+ BEV drivers.

The big insight? Charging growth is diversifying. China still leads, but countries like India, Thailand, and Brazil are rising fast despite lower EV penetration. Meanwhile, fast charging is gaining ground everywhere, especially in MENA and Southeast Asia.

The report also highlights that nearly 50% of charging now happens away from home, with improving satisfaction levels in public networks.

It’s one of the clearest snapshots of how charging ecosystems are evolving globally and what regions are skipping slow rollouts to scale directly.

Most EVs already have enough range for daily life. That’s not what drivers stress over.

What matters now is who controls the experience at the plug: the wait times, the location, the billing, the uptime.

🛠️ China is forcing open access at every OEM-built charger.

🗺️ India is tying charging subsidies to local manufacturing.

🇺🇸 Tesla decides who gets access and at what voltage.

🏙️ In the UK, charging networks are competing on home access for drivers without driveways.

The edge is shifting from what’s inside the car to what happens outside of it, at the curb, in the lot, and under the cable.

EV adoption won’t stall because of range, but because the wrong players control the wrong parts of infrastructure.

📬 Hit reply and tell us: Where do you actually charge and what makes that spot win your trust?