From EVs and batteries to autonomous vehicles and urban transport, we cover what actually matters. Delivered to your inbox weekly.

Tesla took two major steps forward in its autonomous vehicle strategy this week, expanding its robotaxi footprint and securing the supply chain it needs to scale.

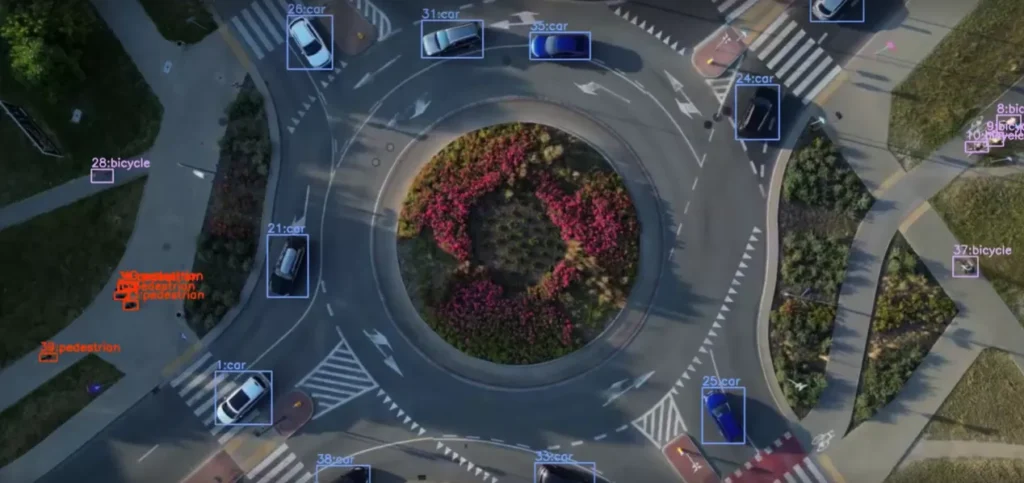

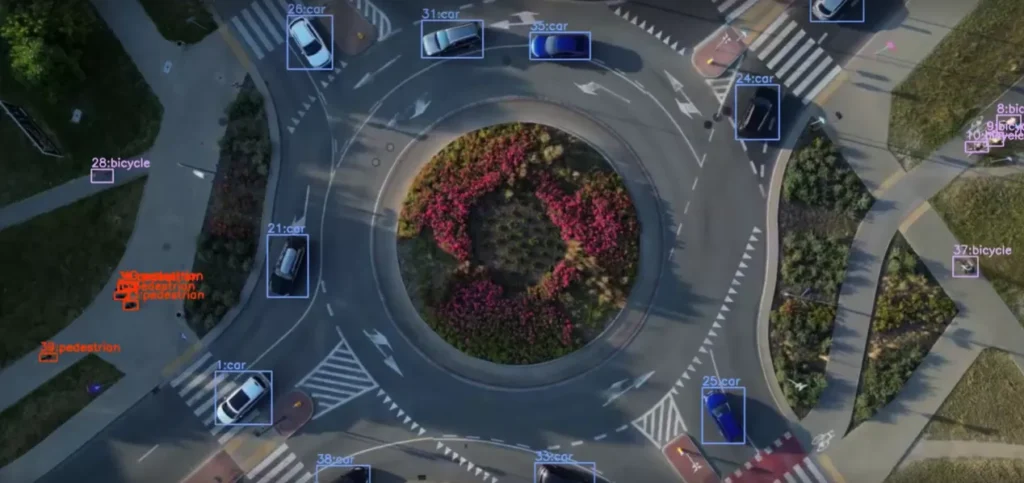

In Austin, the company nearly doubled the size of its robotaxi service area. The vehicles operate with dynamic pricing aimed at undercutting rideshare competitors like Uber and Lyft. In California’s Bay Area, Tesla has now begun offering autonomous rides with safety drivers. Testing in denser cities marks a critical shift—closer to real-world complexity, and under tighter regulatory constraints.

At the same time, Tesla finalized a $16.5 billion deal with Samsung to supply next-generation batteries and AI chips. These components will support not just increased robotaxi volume, but the compute power needed to run Tesla’s full self-driving (FSD) system at scale. The size of the deal signals more than just vehicle production—it’s Tesla vertically integrating the brains of its entire autonomous platform.

Evidence of that strategy is starting to show. Tesla’s new Cybercab, likely built around custom ride-hailing hardware, was spotted operating driverless in Austin. It’s an early look at the vehicle that could anchor Tesla’s commercial robotaxi network. But progress hasn’t come without friction: a $243 million lawsuit tied to Autopilot safety remains unresolved.

Internally, Tesla is evolving the FSD stack by merging it with two of its broader AI projects—the Optimus humanoid robot platform and the Grok large-language model. Together, they aim to improve the decision-making layer of autonomy, handling of edge cases, and vehicle-human interface. While still experimental, they reflect Tesla’s ambition to run increasingly general-purpose AI models inside every car.

Behind each move is a defining bet: that vertical control—from AI models to chip supply—will give Tesla the margin leverage and speed to outpace rivals. But with scaling comes scrutiny. As Tesla inches toward driverless operation in complex markets, it remains under pressure to prove its autonomy system is not just fast, but safe.

What matters now: whether Tesla can deploy a fully driverless robotaxi fleet in major cities. That outcome, more than test rides or chip deals, will determine if this expansion is the foundation of a real business—or another high-profile pilot.